Catch-all

This is a catch-all bucket where you can find various short videos, answers to questions, and brief explanations.

We will try to organize the information better over time, but at least it's available here. Think of it as a treasure hunt. ;-)

1/6/22

Getting Acclimated

just make sure you log in to tradier through TU so we can access live data for you: https://www.youtube.com/watch?v=psI0V94jvNY&list=PLKjQe4oyXLvJzJRT8cb8BQPGiYaQE78r9&index=10

hey, so id start with this playlist here: https://www.youtube.com/watch?v=vjXUr7dLDoI&list=PLKjQe4oyXLvKmtBLmnVOcUMiFsMbRVNal

this playlist is a tutorial on the user interface for managing a tradeplan: https://www.youtube.com/watch?v=QoSUGSVVG7Q&list=PLKjQe4oyXLvLfbp5lHNNrL3OkXeSTAiMO

10/8/21

a quick video explaining the feature addition of the restart button to "persist if filter/validation failure" https://www.screencast.com/t/Mkx8QxCQl8a

10/13/21

how you can use saved templates to quickly load up tradeplans https://www.screencast.com/t/AM6Zu9TO8

the simplest way is to use persist if filter failed validation. this will allow you to manually take over a tradeplan that has been filtered out https://www.screencast.com/t/CeYEWJ9iom there are about 3 other ways, but let me know if that does it for you. if it doesnt, ill gladly go over the others

10/20/21

use ATR instead of a pivot that is too far out https://www.screencast.com/t/ZVqjV9kyzQ5O

the example I used was facebook. Facebook has an atr of 8, and the 3 nearest pivots were 345.03, 345.23, 349.6

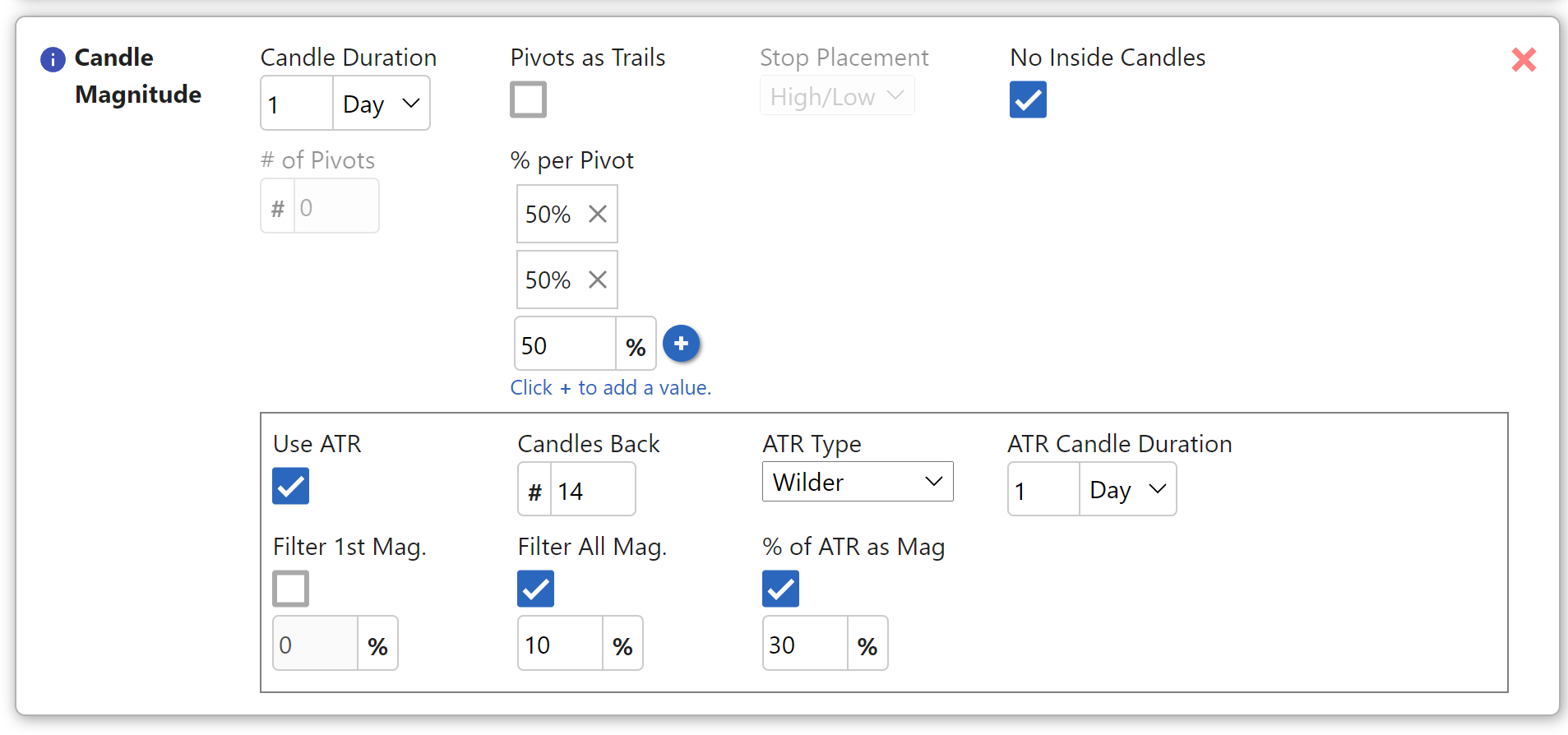

lets say we use the following configuration for magnitudes. This will make sure pivots are spaced by at least 10% of the atr (by filtering any magnitude within 10% of atr), and it will also make sure that if the next magnitude is more than 30% of atr away, it will use 30% of the atr plus the last pivot, as the next pivot.

lets say we use the following configuration for magnitudes. This will make sure pivots are spaced by at least 10% of the atr (by filtering any magnitude within 10% of atr), and it will also make sure that if the next magnitude is more than 30% of atr away, it will use 30% of the atr plus the last pivot, as the next pivot.

So with an entry of 342.5, the software will interact as follows:

10% of atr is 0.8 (for filter). 30% of atr is 2.4 (to use mag instead).

So with an entry of 342.5, the software will interact as follows:

10% of atr is 0.8 (for filter). 30% of atr is 2.4 (to use mag instead).

a) magnitude 345.03. This passes "filter all mag", as it is more than 0.8 away from the entry of 342. However, it is further than 344.9 (342.5 entry+2.4 atr), which is 30% of the ATR away from the entry price. The first pivot therefore will be selected based off the ATR at 344.9.

b) magnitude 345.23. This fails "filter all mag", as it is less than 0.8 away from the previous pivot of 344.9

c) magnitude. 349.6. This passes "filter all mag", as it is more than 0.8 away from the last pivot of 344.9. However, it is further than 347.3 (344.9 entry+2.4 atr), which is 30% of the ATR away from the last pivot. The first pivot therefore will be selected based off the ATR at 347.3.

10/21/21

To explain the "filter all mag" and "% of ATR as mag", let's use QS as an example. let's say we set up a tradeplan to enter long on the break of inside day at 25.35

without any of the ATR functionality, the machine would find pivots at 25.36, 25.63, 27.08, 28.05, 28.74

The first thing that should stand out as an issue is the first pivot at 25.36, which is one penny. This is a magnitude that you are probably going to want to skip. This is where "filter all mag" comes in. It will filter out a clustered pivot.

without any of the ATR functionality, the machine would find pivots at 25.36, 25.63, 27.08, 28.05, 28.74

The first thing that should stand out as an issue is the first pivot at 25.36, which is one penny. This is a magnitude that you are probably going to want to skip. This is where "filter all mag" comes in. It will filter out a clustered pivot.

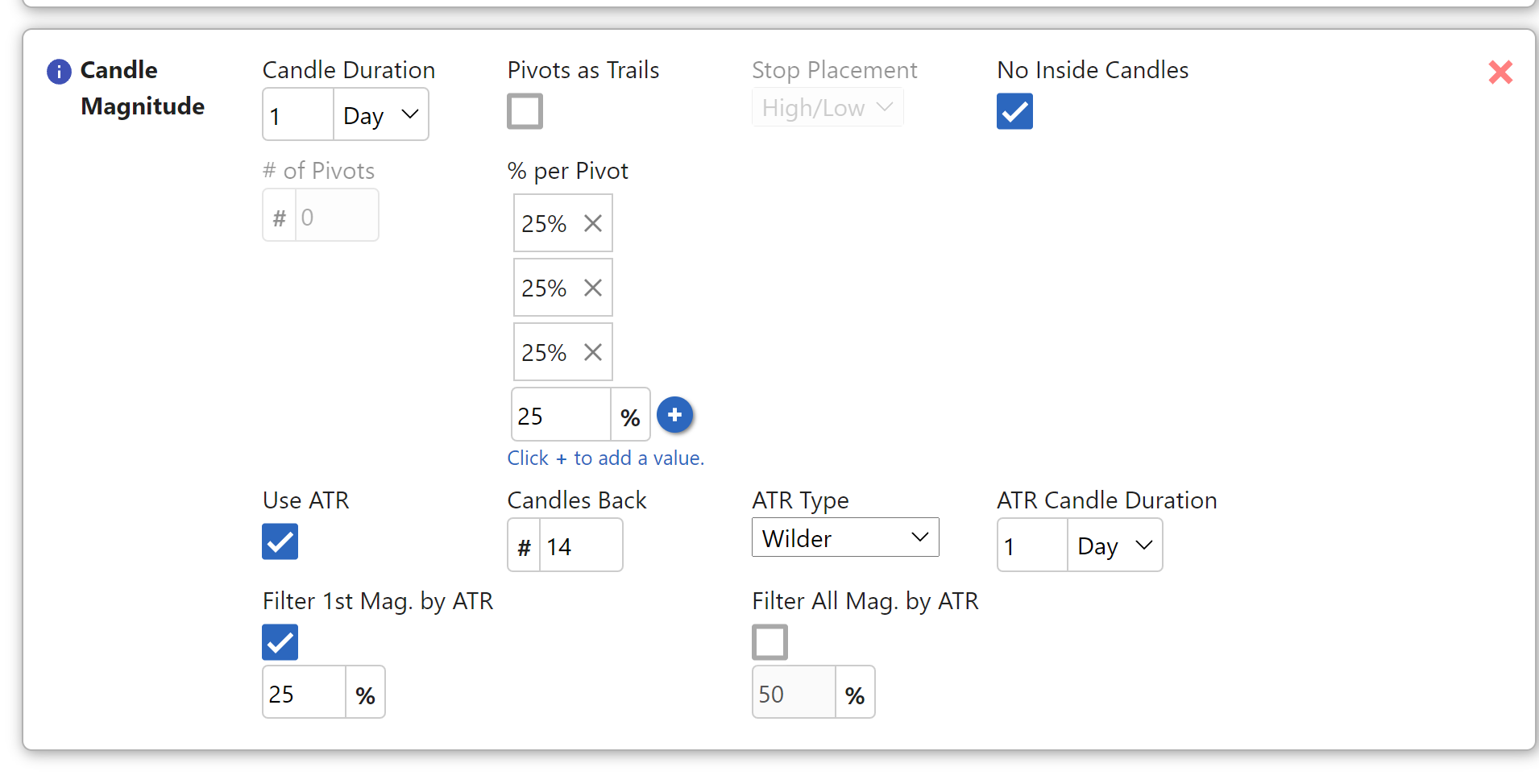

Let's use the above configuration, in which filter all mag was set to 10%. 10% of the ATR (1.7 in the image) is 17 cents.

This filter works as follows: take the entry/lastPivot and add that 17 cents to it. Any upcoming pivots below that range get filtered out. This happens with every potentially new pivot. As a result, the too near pivot of 25.36 will get filtered out. The upcoming pivot after that, at 25.63 will become the first pivot

The second issue that should stand out to you about the above pivots is after that 25.63 pivot, the pivots become really extended, and you need long pivots to reach those pivots. This is where the % of ATR as mag comes in to play. It allows you to replace a pivot with % of ATR

Let's use 50%, like in the above configuration. 50% of the ATR (1.7) is around .85. Any time the pivot is further out than this range, we will use this as the magnitude instead. Just to reiterate, the above is a filter that says anything within a range, ignore the pivot. This says the opposite, anytime a pivot is outside of this range, use the % of atr as a pivot instead.

So let's walk through the example now... The first number we are looking at is 26.2. This is the entry price of 25.35 + half of the atr of .85. The first pivot that passes the filter test above is 25.63. This pivot is below 26.2, so the software allows this to be used as the first pivot.

The next pivot though is 27.08. If you take 25.63 (the last pivot) and add .85 (half the atr), you get 26.48. 27.08 is well beyond 26.48. Therefore, our second target, instead of being 27.08, is tracked at 26.48.

Our list of targets at this point would be 25.63 and 26.48 I can keep going with the above example, but let me know if this makes sense. These two features provide both the goal of ignoring magnitudes that are too clustered, and using atr instead of magnitude as a target if the next magnitude is too far away

another example on facebook: https://www.screencast.com/t/ZVqjV9kyzQ5O

5min vid on "use atr": https://www.screencast.com/t/5XJr5sLZhUe

example of pins from 10/18:

https://www.screencast.com/t/5XJr5sLZhUe

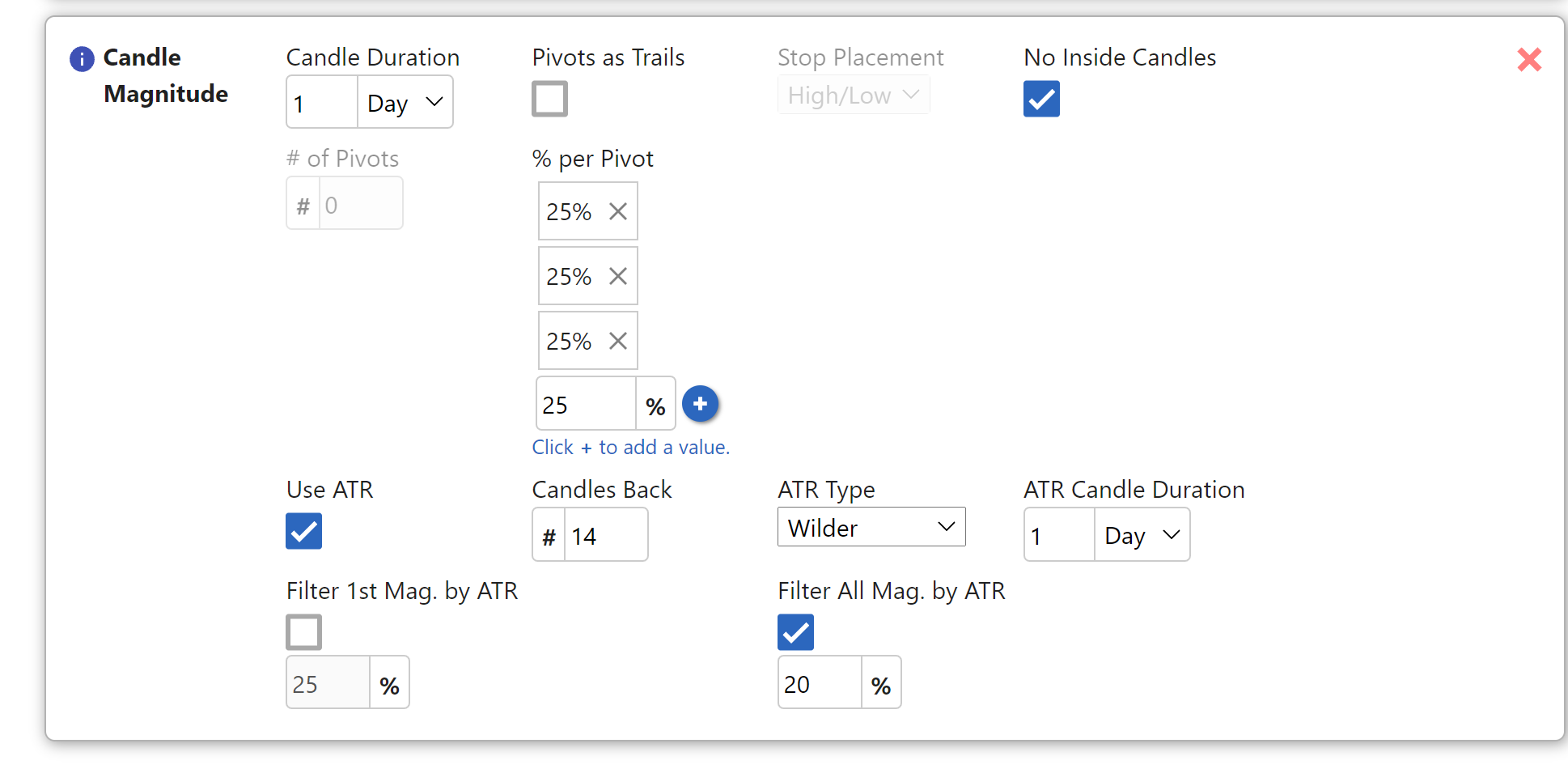

quick example here... this is saying that if the first pivot is within 25% of the ATR from the entry price, to skip this pivot, and use the next.

so if you look at pins, the ATR on TOS using 14 candles back on the daily chart and wilders is 1.78. 25% of that is .45.

so if you look at pins, the ATR on TOS using 14 candles back on the daily chart and wilders is 1.78. 25% of that is .45.

The way the software works is as follows: Let's say you were to take inside day break on pins at 53.27. The software will go 53.27+.45=53.72. Any pivot that can potentially be the "first pivot" will be ignored. this means that first pivot on the 3 bar at 53.4 will be passed. the next pivot at 54.03 will be used instead. once the first pivot is found, this filter is deactivated

this example, is saying to filter all pivots by 20% of the ATR. this is different than the first filter in that it will not only apply to the first pivot, but to all pivots found after

The example I used in the video was wday. With wday, lets say you were to take inside day break at 272.35. Wday has an atr of 6.93. 20% of the ATR will equal 1.39.

Without this filter, wday would have pivots of: 273.55, 273.98, 274.98, 275.63, 277.58, 278.23 (The software would find more going further back in time, but for the sake of this example, we will stop here).

With the above atr filter, the software will select pivots as follows: 272.35 (entry) +1.39 (percent of atr) = 273.74. This means that the first pivot of 273.55 will be ignored. The first pivot chosen will be 273.98.

273.98 (last pivot) +1.39=275.37. The 274.98 pivot will be ignored, and the 275.63 pivot will be used next instead.

275.63 (last pivot) + 1.39 = 277.02. The next pivot of 277.58 will be used next.

277.58 (last pivot) + 1.39 = 278.97. the pivot at 278.23 will be ignored.

Therefore, we are left with pivots at 273.98, 275.63, and 277.58

12/1/21

using a saved config to get into an otm1 option... I think its about 7-8 clicks. The alternative is already having the stock up in a tradeplan and then just clicking enter long or enter short https://www.screencast.com/t/IJ89l8b2G3

manual selection from option chain, obviously a little bit slower https://www.screencast.com/t/OJexdrFkiy4

9/1/21

brief overview on how to manually select options https://www.screencast.com/t/LglWLOla

in depth explanation of working the order: https://www.screencast.com/t/kexL5Mkykti

9/3/21

this setup will setup a trigger based on the break of yesterdays high/low (depending on if you are long/short trade direction). validate candle will say if the setup opens above yesterdays high, filter out the trade (most ppl like to have it open as a 1, and then enter on the break)

8/24/21

![]()

8/10/21

Two ways to trade ORBs https://youtu.be/osyXHmcZz_Y

7/7/21

Juggling multiple positions https://youtu.be/oGtYhDW-pOw

9/23/21

a very brief orientation for some of the new UI controls

https://www.screencast.com/t/LYzc8trET

10/28/21

Sharing and importing Trade Plan templates https://www.screencast.com/t/2jgsxpYzaN

10/21/21

Candle Pattern setup a la #TheStrat https://www.screencast.com/t/YfneVsG9

1/13/22

Underlying Price Exit: https://www.screencast.com/t/LdKJ3eDdsW

Placing targets for options on underlying chart: https://www.screencast.com/t/ymnwTQAw88B

11/30/21

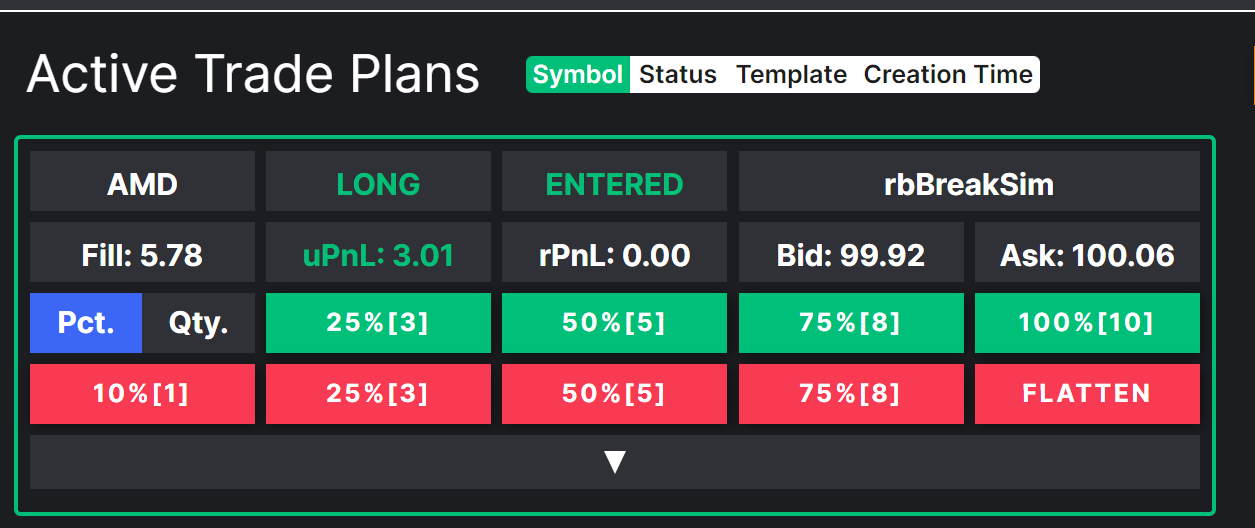

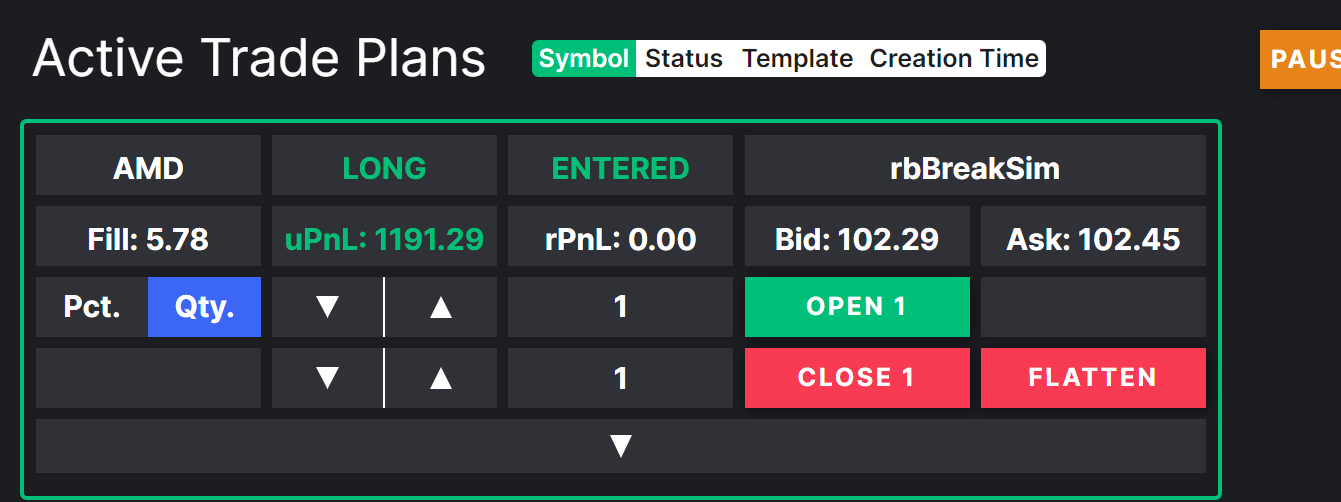

this is the new tradeplan header for when you are in a position. the new feature is the ability to add to the position from this module. You can also add or subtract to the position, via pct (the left image), or qty (the right image). With percentage, keep in mind it works the same way as the closing buttons. The percentage is always relative to the total qty bought in the course of this tradeplan. So if you originally had 5 contracts, and you hit 100%, and now had 10 contracts, if you hit 100% again, it will purchase 10 more contracts, and you will now have 20 contracts. video incoming...

https://www.screencast.com/t/GppSRdf7rLKz tutorial on the new buttons

1/6/22

Worked Orders:

if the trade is bto, and the % between bid ask was 0%, the limit order would start at the bid.

if the trade is sto, and the % between bid ask was 0%, the limit order would start at the ask.

11/25/21

tutorial on how to split and separate parameters on entry and exit for work order https://www.screencast.com/t/tmFxezY564g

break by on trigger candle for candle pattern setup tutorial.. https://www.screencast.com/t/DXWUu5DLcS

manual reactivate long/short on candle trigger setup tutorial (manual unbonking) https://www.screencast.com/t/MqLhZj1r

11/23/21

editing candle mag exit in new UI https://www.screencast.com/t/AR9izxst1ERZ

how to "manipulate tu" to be able to trade like you would on another platform. ie enter from an existing chart, manual exits that type of stuff. It is a bit of a hack, but it is effective https://www.screencast.com/t/wYpQrAoO

how to compare fill versus quote at time of attempted trade. could be useful for evaluating work order results https://www.screencast.com/t/imXfgVkY

10/29/21

video explanation of the initial stop and first target stop for ATR. sorry its 8 minutes once again.. just a lot of stuff to include https://www.screencast.com/t/zKorqYBkbew

just a quick explanation of what to be aware of if trading on different timeframes... https://www.screencast.com/t/nPPTlPZdq55

1/2/22

MFE Retracement

It's saying if pnl reaches a certain amount (defined by either an amount or %), never let it retrace below x%. This is like what you said above. The additional wrinkle is that as profit increases, the stop will increase/expand along with it. So when pnl is 500, if the retrace pct is 50%, the stop will be 250 pnl. When pnl is 1000, the stop will be 500 pnl.

To do the settings in this message, 1) you would set mfe type to pnl, 2)activation type/setting to amount, 3)pnl type to overall, 4) activation amount to 500 5) retrace pct to 50%

12/31/21

Mfe Retracement Documentation: online documentation: https://wiki.tradeunafraid.com/en/creating-a-trade-plan/exit-tactics/mfe-retracement

video explanation of fields: https://www.screencast.com/t/C8yaY9Lg

live example on simulated data: https://www.screencast.com/t/amTLGD1hIm

12/22/21

simplest ways to trade TheStrat with TU:

- enter on break of previous candle setup: adhoc entry: candle break exit: candle trail if take profit: candle magnitude

- for trading break of previous day/week/month high setup: candle trigger entry: market order exit: candle trail if take profit: candle magnitude

- for trading a specific sequence on the intraday time frame setup: candle pattern entry: market order exit: candle trail if take profit: candle magnitude

Nav Bar

https://www.youtube.com/watch?v=vjXUr7dLDoI&list=PLKjQe4oyXLvKmtBLmnVOcUMiFsMbRVNal

12/11/21

example vid of manual option selection from a few days ago: https://www.screencast.com/t/OJexdrFkiy4

an otm1 option saved config that you can use as an "enter now tradeplan": https://www.screencast.com/t/IJ89l8b2G3

12/21/21

Generating pivots based off of the atr when no pivots remain https://www.screencast.com/t/q1vKfNgbcbK

How to alter work order settings of an existing tradeplan: https://www.screencast.com/t/mHtZ20oEaDr